Supreme Court Judgments 2022

by: Adv. Kishan Dutt Kalaskar 2022-11-02 17:33:56

by: Adv. Kishan Dutt Kalaskar 2022-11-02 17:33:56

by: Admin 2022-06-15 18:50:14

by: Admin 2022-06-15 17:09:55

by: Admin 2022-04-28 20:02:29

by: Admin 2022-04-28 19:00:07

by: Admin 2022-04-28 14:03:30

Supreme Court Judgments 2022

Mohan Breweries & Distilleries V/s Commercial Tax officer, Madras

Kavita Kanwar Vs. Mrs Pamela Mehta & Ors

Parminder Kaur V/s State of Punjab

Central Bank of India V/s M/S Maruti Acetylene Co. Ltd.

Goan Real Estate and Construction Ltd. And Anr. V/s Union of India

Raj Kumar V/s Ajay Kumar

Dr. M. Kocher V/s Ispita Seal

Smt. Seema Kumar V/s Ashwin Kumar

Leo Francis Xaviour V/s The Principal, Karunya Institute

Nazir Mohamed V/s J. Kamala and Ors.

Addissery Raghavan V/s Cheruvalath Krishnadasan

Himalaya House Co. Ltd. Bombay V/s Chief Controlling Revenue

K. Sivaram V/s P. Satishkmar

Basir Ahmed Sisodia V/s The Income Tax Officer

Manish V/s Nidhi Kakkar

Surendra Kumar Bhilawe V/s The New India Assurance Company

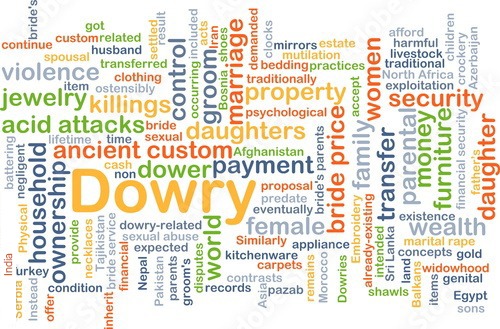

D. Velusamy V/s D. Patchaimmal

Life Insurance Corporation of India V/s Mukesh Poonamchand Shah

Neelam Gupta Vs Mahipal Sharan Gupta

Sou. Sandhya Manoj Wankhade V/s Manoj Bhimrao Wankhade

G. Raj Mallaih and Anr. V/s State of Andhra Pradesh

Zee Entertainment Enterprise Ltd. V/s Suresh Production

Chief Administrator of Huda &Anr. v/s Shakuntala Devi

Ambalal Sarabhai Enterprise v/s Ks Infraspace LLP

National Legal Service Authority v/s Union of India and Others

Roxann Sharma V/s Arun Sharma

Ganesh Santa Ram Sirur V/s State Bank of India &Anr.

M/s M.M.T.C Ltd. & Anr v/s M/s Medchl Chemical & Pharma P

Shailendra Swarup V/s Enforcement Directorate, The Deputy

SunitaTokas v/s New India Insurance Ltd.

Triloki Nath Singh V/s Anirudh Singh

Milmet Oftho & Ors. V/s Allergan Inc.

Director of Income Tax II (International Taxation) V/s M/s Samsung Heavy Industries Co. Ltd.

M/s ExL Careers V/s Frankfinn Aviation Services Pvt. Ltd.

The Maharashtra State Cooperative Bank Ltd V/s Babulal Lade & Ors.

State of Himachal Pradesh V/s A parent of a student of a Medical College & Ors.

Rathnamma & Ors. V/s Sujathamma & Ors.

Ravinder Kaur Grewal V/s Manjit Kaur

Ficus Pax Pvt. Ltd. V/s Union of Indian & Ors.

Commissioner of Income Tax V/s Chandra Sekhar

Judgment: Indian Bank V/s Abs Marine Product Pvt. Ltd.

Kailas & Ors. V/s State of Maharashtra

Sukhedu Das Vs Rita Mukherjee

National Insurance Co. Ltd V/s Hindustan Safety Glass Works

Mahalakshmi V/s Bala Venkatram (d) through LR & Anr.

Kajal V/s Jagdish Chand

Shyamal Kumar V/s Sushil Kumar Agarwal

Megha Khandelwal V/s Rajat Khandelwal and Ors.

Md. Eqbal & Anrs. V/s State of Jharkhand

A. Jayachandra V/s Aneelkaur

Union of India V/s N. K. Shrivasta

Satvinder Singh V/s State of Bihar

Shreya Singhal V/s Union of India

Shaleen Kabra V/s Shiwani Kabra

Vasant Kumar V/s Vijaykumari

United Commercial Bank & Anr. V/s Deepak Debbarma & others

Vinay Kumar Mittal & Others V/s Deewan Housing Financial Corporation Limited

Mohammed Siddique Vs National Insurance Company Ltd

Top 2019 judgements by Supreme Court

The appeal was filed by the National Insurance Co. Ltd against Hindustan Safety Glass Works regarding the claims they asked from the insurance company. The respondent Hindustan Safety Glass Works Ltd, had taken out two policies with the appellant National Insurance Company. The city Calcutta witnessed heavy incessancy rain on 6th August, 1992 due to which heavy water accumulated near the factory and ground of the respondent. As per the reports of the respondent, there was considerable damage caused to raw materials, stocks and goods, furniture, other materials, etc. All this damage led to a lot of loss which was suffered by the insured. Due to this, the insured on 7th and 8th August, filed claims from the insurance company based on the two policies that was done with the insurance company. The insured claimed an amount of Rs.52.32 lakhs along with an amount of Rs.1.81 being those expenses which incurred for the purpose of loss minimization. With these, an interest at 18% per annum was also claimed by the insured, with effect from 6th December, 1992, that is four months after the occurrence of the flood or the inundation. All these claims didn’t go well with the National Insurance Company and therefore an appeal was filed by the insurance company in the National Commission.

The National Commission rejected all the contentions urged by the National insurance company and through an impugned judgment an order was issued and the insured was awarded an amount of Rs. 21,05,803.89 with interest at 9% per annum from 11th May, 1995 that is three months after the addendum issued by Seascan Services (WB) Pvt. Ltd. (the second surveyor). An appeal was then made in the Supreme Court.

Issues of the Case

Judgment

According to the facts of the case, the Supreme Court held that on the date of the incident, the goods of the respondent were already insured. On the very next day, a claim was lodged by the company with the national insurance company. In reply to this, the national insurance first appointed a surveyor to assess the loss suffered by the respondent who submitted a report on the same after more than a year. After this, without giving proper reasons, the national insurance appointed a second surveyor which further took one year to submit its report along with the addendum. So, an addendum and a report was submitted, after again a year of time. In simple words, the national insurance, itself took more than two years in surveying or causing a survey of the loss or damage suffered by the insured. This entire delay in their investigation is surely attributable to National Insurance and cannot prejudice the claim of the respondent, more particularly when the respondent had already lodged a claim well within the time specified.

The Supreme Court of India, while resolving the issue of the case, held that, when a dispute is related to a consumer, it becomes necessary for the courts to consider a pragmatic view of the rights of the consumer principally, since it is the consumer who is placed at a disadvantage vis-à-vis the supplier of services or goods. The main agenda behind formulating the Consumer Protection Act, 1996, was to overcome this disadvantage and therefore, this legislation was enacted by the parliament. The provision of limitation in the mentioned Act cannot be strictly construed to disadvantage a consumer in a case where a supplier of goods or services itself is instrumental in causing a delay in the settlement of the consumer claim.

The Supreme Court further held that a right decision was taken by the national commission in rejecting the contention of the National Insurance, in the discussed case, and therefore the appeal was dismissed by the Supreme Court.

">

Civil Appeal No. 3883 Of 2007

Facts of the Case:

The appeal was filed by the National Insurance Co. Ltd against Hindustan Safety Glass Works regarding the claims they asked from the insurance company. The respondent Hindustan Safety Glass Works Ltd, had taken out two policies with the appellant National Insurance Company. The city Calcutta witnessed heavy incessancy rain on 6th August, 1992 due to which heavy water accumulated near the factory and ground of the respondent. As per the reports of the respondent, there was considerable damage caused to raw materials, stocks and goods, furniture, other materials, etc. All this damage led to a lot of loss which was suffered by the insured. Due to this, the insured on 7th and 8th August, filed claims from the insurance company based on the two policies that was done with the insurance company. The insured claimed an amount of Rs.52.32 lakhs along with an amount of Rs.1.81 being those expenses which incurred for the purpose of loss minimization. With these, an interest at 18% per annum was also claimed by the insured, with effect from 6th December, 1992, that is four months after the occurrence of the flood or the inundation. All these claims didn’t go well with the National Insurance Company and therefore an appeal was filed by the insurance company in the National Commission.

The National Commission rejected all the contentions urged by the National insurance company and through an impugned judgment an order was issued and the insured was awarded an amount of Rs. 21,05,803.89 with interest at 9% per annum from 11th May, 1995 that is three months after the addendum issued by Seascan Services (WB) Pvt. Ltd. (the second surveyor). An appeal was then made in the Supreme Court.

Issues of the Case

Judgment

According to the facts of the case, the Supreme Court held that on the date of the incident, the goods of the respondent were already insured. On the very next day, a claim was lodged by the company with the national insurance company. In reply to this, the national insurance first appointed a surveyor to assess the loss suffered by the respondent who submitted a report on the same after more than a year. After this, without giving proper reasons, the national insurance appointed a second surveyor which further took one year to submit its report along with the addendum. So, an addendum and a report was submitted, after again a year of time. In simple words, the national insurance, itself took more than two years in surveying or causing a survey of the loss or damage suffered by the insured. This entire delay in their investigation is surely attributable to National Insurance and cannot prejudice the claim of the respondent, more particularly when the respondent had already lodged a claim well within the time specified.

The Supreme Court of India, while resolving the issue of the case, held that, when a dispute is related to a consumer, it becomes necessary for the courts to consider a pragmatic view of the rights of the consumer principally, since it is the consumer who is placed at a disadvantage vis-à-vis the supplier of services or goods. The main agenda behind formulating the Consumer Protection Act, 1996, was to overcome this disadvantage and therefore, this legislation was enacted by the parliament. The provision of limitation in the mentioned Act cannot be strictly construed to disadvantage a consumer in a case where a supplier of goods or services itself is instrumental in causing a delay in the settlement of the consumer claim.

The Supreme Court further held that a right decision was taken by the national commission in rejecting the contention of the National Insurance, in the discussed case, and therefore the appeal was dismissed by the Supreme Court.

">

Civil Appeal No. 3883 Of 2007

Facts of the Case:

The appeal was filed by the National Insurance Co. Ltd against Hindustan Safety Glass Works regarding the claims they asked from the insurance company. The respondent Hindustan Safety Glass Works Ltd, had taken out two policies with the appellant National Insurance Company. The city Calcutta witnessed heavy incessancy rain on 6th August, 1992 due to which heavy water accumulated near the factory and ground of the respondent. As per the reports of the respondent, there was considerable damage caused to raw materials, stocks and goods, furniture, other materials, etc. All this damage led to a lot of loss which was suffered by the insured. Due to this, the insured on 7th and 8th August, filed claims from the insurance company based on the two policies that was done with the insurance company. The insured claimed an amount of Rs.52.32 lakhs along with an amount of Rs.1.81 being those expenses which incurred for the purpose of loss minimization. With these, an interest at 18% per annum was also claimed by the insured, with effect from 6th December, 1992, that is four months after the occurrence of the flood or the inundation. All these claims didn’t go well with the National Insurance Company and therefore an appeal was filed by the insurance company in the National Commission.

The National Commission rejected all the contentions urged by the National insurance company and through an impugned judgment an order was issued and the insured was awarded an amount of Rs. 21,05,803.89 with interest at 9% per annum from 11th May, 1995 that is three months after the addendum issued by Seascan Services (WB) Pvt. Ltd. (the second surveyor). An appeal was then made in the Supreme Court.

Issues of the Case

Judgment

According to the facts of the case, the Supreme Court held that on the date of the incident, the goods of the respondent were already insured. On the very next day, a claim was lodged by the company with the national insurance company. In reply to this, the national insurance first appointed a surveyor to assess the loss suffered by the respondent who submitted a report on the same after more than a year. After this, without giving proper reasons, the national insurance appointed a second surveyor which further took one year to submit its report along with the addendum. So, an addendum and a report was submitted, after again a year of time. In simple words, the national insurance, itself took more than two years in surveying or causing a survey of the loss or damage suffered by the insured. This entire delay in their investigation is surely attributable to National Insurance and cannot prejudice the claim of the respondent, more particularly when the respondent had already lodged a claim well within the time specified.

The Supreme Court of India, while resolving the issue of the case, held that, when a dispute is related to a consumer, it becomes necessary for the courts to consider a pragmatic view of the rights of the consumer principally, since it is the consumer who is placed at a disadvantage vis-à-vis the supplier of services or goods. The main agenda behind formulating the Consumer Protection Act, 1996, was to overcome this disadvantage and therefore, this legislation was enacted by the parliament. The provision of limitation in the mentioned Act cannot be strictly construed to disadvantage a consumer in a case where a supplier of goods or services itself is instrumental in causing a delay in the settlement of the consumer claim.

The Supreme Court further held that a right decision was taken by the national commission in rejecting the contention of the National Insurance, in the discussed case, and therefore the appeal was dismissed by the Supreme Court.

">

Civil Appeal No. 3883 Of 2007

Facts of the Case:

The appeal was filed by the National Insurance Co. Ltd against Hindustan Safety Glass Works regarding the claims they asked from the insurance company. The respondent Hindustan Safety Glass Works Ltd, had taken out two policies with the appellant National Insurance Company. The city Calcutta witnessed heavy incessancy rain on 6th August, 1992 due to which heavy water accumulated near the factory and ground of the respondent. As per the reports of the respondent, there was considerable damage caused to raw materials, stocks and goods, furniture, other materials, etc. All this damage led to a lot of loss which was suffered by the insured. Due to this, the insured on 7th and 8th August, filed claims from the insurance company based on the two policies that was done with the insurance company. The insured claimed an amount of Rs.52.32 lakhs along with an amount of Rs.1.81 being those expenses which incurred for the purpose of loss minimization. With these, an interest at 18% per annum was also claimed by the insured, with effect from 6th December, 1992, that is four months after the occurrence of the flood or the inundation. All these claims didn’t go well with the National Insurance Company and therefore an appeal was filed by the insurance company in the National Commission.

The National Commission rejected all the contentions urged by the National insurance company and through an impugned judgment an order was issued and the insured was awarded an amount of Rs. 21,05,803.89 with interest at 9% per annum from 11th May, 1995 that is three months after the addendum issued by Seascan Services (WB) Pvt. Ltd. (the second surveyor). An appeal was then made in the Supreme Court.

Issues of the Case

Judgment

According to the facts of the case, the Supreme Court held that on the date of the incident, the goods of the respondent were already insured. On the very next day, a claim was lodged by the company with the national insurance company. In reply to this, the national insurance first appointed a surveyor to assess the loss suffered by the respondent who submitted a report on the same after more than a year. After this, without giving proper reasons, the national insurance appointed a second surveyor which further took one year to submit its report along with the addendum. So, an addendum and a report was submitted, after again a year of time. In simple words, the national insurance, itself took more than two years in surveying or causing a survey of the loss or damage suffered by the insured. This entire delay in their investigation is surely attributable to National Insurance and cannot prejudice the claim of the respondent, more particularly when the respondent had already lodged a claim well within the time specified.

The Supreme Court of India, while resolving the issue of the case, held that, when a dispute is related to a consumer, it becomes necessary for the courts to consider a pragmatic view of the rights of the consumer principally, since it is the consumer who is placed at a disadvantage vis-à-vis the supplier of services or goods. The main agenda behind formulating the Consumer Protection Act, 1996, was to overcome this disadvantage and therefore, this legislation was enacted by the parliament. The provision of limitation in the mentioned Act cannot be strictly construed to disadvantage a consumer in a case where a supplier of goods or services itself is instrumental in causing a delay in the settlement of the consumer claim.

The Supreme Court further held that a right decision was taken by the national commission in rejecting the contention of the National Insurance, in the discussed case, and therefore the appeal was dismissed by the Supreme Court.

">

Facts of the Case:

The appeal was filed by the National Insurance Co. Ltd against Hindustan Safety Glass Works regarding the claims they asked from the insurance company. The respondent Hindustan Safety Glass Works Ltd, had taken out two policies with the appellant National Insurance Company. The city Calcutta witnessed heavy incessancy rain on 6th August, 1992 due to which heavy water accumulated near the factory and ground of the respondent. As per the reports of the respondent, there was considerable damage caused to raw materials, stocks and goods, furniture, other materials, etc. All this damage led to a lot of loss which was suffered by the insured. Due to this, the insured on 7th and 8th August, filed claims from the insurance company based on the two policies that was done with the insurance company. The insured claimed an amount of Rs.52.32 lakhs along with an amount of Rs.1.81 being those expenses which incurred for the purpose of loss minimization. With these, an interest at 18% per annum was also claimed by the insured, with effect from 6th December, 1992, that is four months after the occurrence of the flood or the inundation. All these claims didn’t go well with the National Insurance Company and therefore an appeal was filed by the insurance company in the National Commission.

The National Commission rejected all the contentions urged by the National insurance company and through an impugned judgment an order was issued and the insured was awarded an amount of Rs. 21,05,803.89 with interest at 9% per annum from 11th May, 1995 that is three months after the addendum issued by Seascan Services (WB) Pvt. Ltd. (the second surveyor). An appeal was then made in the Supreme Court.

Issues of the Case

Judgment

According to the facts of the case, the Supreme Court held that on the date of the incident, the goods of the respondent were already insured. On the very next day, a claim was lodged by the company with the national insurance company. In reply to this, the national insurance first appointed a surveyor to assess the loss suffered by the respondent who submitted a report on the same after more than a year. After this, without giving proper reasons, the national insurance appointed a second surveyor which further took one year to submit its report along with the addendum. So, an addendum and a report was submitted, after again a year of time. In simple words, the national insurance, itself took more than two years in surveying or causing a survey of the loss or damage suffered by the insured. This entire delay in their investigation is surely attributable to National Insurance and cannot prejudice the claim of the respondent, more particularly when the respondent had already lodged a claim well within the time specified.

The Supreme Court of India, while resolving the issue of the case, held that, when a dispute is related to a consumer, it becomes necessary for the courts to consider a pragmatic view of the rights of the consumer principally, since it is the consumer who is placed at a disadvantage vis-à-vis the supplier of services or goods. The main agenda behind formulating the Consumer Protection Act, 1996, was to overcome this disadvantage and therefore, this legislation was enacted by the parliament. The provision of limitation in the mentioned Act cannot be strictly construed to disadvantage a consumer in a case where a supplier of goods or services itself is instrumental in causing a delay in the settlement of the consumer claim.

The Supreme Court further held that a right decision was taken by the national commission in rejecting the contention of the National Insurance, in the discussed case, and therefore the appeal was dismissed by the Supreme Court.

">

Civil Appeal No. 3883 Of 2007

Facts of the Case:

The appeal was filed by the National Insurance Co. Ltd against Hindustan Safety Glass Works regarding the claims they asked from the insurance company. The respondent Hindustan Safety Glass Works Ltd, had taken out two policies with the appellant National Insurance Company. The city Calcutta witnessed heavy incessancy rain on 6th August, 1992 due to which heavy water accumulated near the factory and ground of the respondent. As per the reports of the respondent, there was considerable damage caused to raw materials, stocks and goods, furniture, other materials, etc. All this damage led to a lot of loss which was suffered by the insured. Due to this, the insured on 7th and 8th August, filed claims from the insurance company based on the two policies that was done with the insurance company. The insured claimed an amount of Rs.52.32 lakhs along with an amount of Rs.1.81 being those expenses which incurred for the purpose of loss minimization. With these, an interest at 18% per annum was also claimed by the insured, with effect from 6th December, 1992, that is four months after the occurrence of the flood or the inundation. All these claims didn’t go well with the National Insurance Company and therefore an appeal was filed by the insurance company in the National Commission.

The National Commission rejected all the contentions urged by the National insurance company and through an impugned judgment an order was issued and the insured was awarded an amount of Rs. 21,05,803.89 with interest at 9% per annum from 11th May, 1995 that is three months after the addendum issued by Seascan Services (WB) Pvt. Ltd. (the second surveyor). An appeal was then made in the Supreme Court.

Issues of the Case

Judgment

According to the facts of the case, the Supreme Court held that on the date of the incident, the goods of the respondent were already insured. On the very next day, a claim was lodged by the company with the national insurance company. In reply to this, the national insurance first appointed a surveyor to assess the loss suffered by the respondent who submitted a report on the same after more than a year. After this, without giving proper reasons, the national insurance appointed a second surveyor which further took one year to submit its report along with the addendum. So, an addendum and a report was submitted, after again a year of time. In simple words, the national insurance, itself took more than two years in surveying or causing a survey of the loss or damage suffered by the insured. This entire delay in their investigation is surely attributable to National Insurance and cannot prejudice the claim of the respondent, more particularly when the respondent had already lodged a claim well within the time specified.

The Supreme Court of India, while resolving the issue of the case, held that, when a dispute is related to a consumer, it becomes necessary for the courts to consider a pragmatic view of the rights of the consumer principally, since it is the consumer who is placed at a disadvantage vis-à-vis the supplier of services or goods. The main agenda behind formulating the Consumer Protection Act, 1996, was to overcome this disadvantage and therefore, this legislation was enacted by the parliament. The provision of limitation in the mentioned Act cannot be strictly construed to disadvantage a consumer in a case where a supplier of goods or services itself is instrumental in causing a delay in the settlement of the consumer claim.

The Supreme Court further held that a right decision was taken by the national commission in rejecting the contention of the National Insurance, in the discussed case, and therefore the appeal was dismissed by the Supreme Court.

">

Civil Appeal No. 3883 Of 2007

Facts of the Case:

The appeal was filed by the National Insurance Co. Ltd against Hindustan Safety Glass Works regarding the claims they asked from the insurance company. The respondent Hindustan Safety Glass Works Ltd, had taken out two policies with the appellant National Insurance Company. The city Calcutta witnessed heavy incessancy rain on 6th August, 1992 due to which heavy water accumulated near the factory and ground of the respondent. As per the reports of the respondent, there was considerable damage caused to raw materials, stocks and goods, furniture, other materials, etc. All this damage led to a lot of loss which was suffered by the insured. Due to this, the insured on 7th and 8th August, filed claims from the insurance company based on the two policies that was done with the insurance company. The insured claimed an amount of Rs.52.32 lakhs along with an amount of Rs.1.81 being those expenses which incurred for the purpose of loss minimization. With these, an interest at 18% per annum was also claimed by the insured, with effect from 6th December, 1992, that is four months after the occurrence of the flood or the inundation. All these claims didn’t go well with the National Insurance Company and therefore an appeal was filed by the insurance company in the National Commission.

The National Commission rejected all the contentions urged by the National insurance company and through an impugned judgment an order was issued and the insured was awarded an amount of Rs. 21,05,803.89 with interest at 9% per annum from 11th May, 1995 that is three months after the addendum issued by Seascan Services (WB) Pvt. Ltd. (the second surveyor). An appeal was then made in the Supreme Court.

Issues of the Case

Judgment

According to the facts of the case, the Supreme Court held that on the date of the incident, the goods of the respondent were already insured. On the very next day, a claim was lodged by the company with the national insurance company. In reply to this, the national insurance first appointed a surveyor to assess the loss suffered by the respondent who submitted a report on the same after more than a year. After this, without giving proper reasons, the national insurance appointed a second surveyor which further took one year to submit its report along with the addendum. So, an addendum and a report was submitted, after again a year of time. In simple words, the national insurance, itself took more than two years in surveying or causing a survey of the loss or damage suffered by the insured. This entire delay in their investigation is surely attributable to National Insurance and cannot prejudice the claim of the respondent, more particularly when the respondent had already lodged a claim well within the time specified.

The Supreme Court of India, while resolving the issue of the case, held that, when a dispute is related to a consumer, it becomes necessary for the courts to consider a pragmatic view of the rights of the consumer principally, since it is the consumer who is placed at a disadvantage vis-à-vis the supplier of services or goods. The main agenda behind formulating the Consumer Protection Act, 1996, was to overcome this disadvantage and therefore, this legislation was enacted by the parliament. The provision of limitation in the mentioned Act cannot be strictly construed to disadvantage a consumer in a case where a supplier of goods or services itself is instrumental in causing a delay in the settlement of the consumer claim.

The Supreme Court further held that a right decision was taken by the national commission in rejecting the contention of the National Insurance, in the discussed case, and therefore the appeal was dismissed by the Supreme Court.

">

Civil Appeal No. 3883 Of 2007

Facts of the Case:

The appeal was filed by the National Insurance Co. Ltd against Hindustan Safety Glass Works regarding the claims they asked from the insurance company. The respondent Hindustan Safety Glass Works Ltd, had taken out two policies with the appellant National Insurance Company. The city Calcutta witnessed heavy incessancy rain on 6th August, 1992 due to which heavy water accumulated near the factory and ground of the respondent. As per the reports of the respondent, there was considerable damage caused to raw materials, stocks and goods, furniture, other materials, etc. All this damage led to a lot of loss which was suffered by the insured. Due to this, the insured on 7th and 8th August, filed claims from the insurance company based on the two policies that was done with the insurance company. The insured claimed an amount of Rs.52.32 lakhs along with an amount of Rs.1.81 being those expenses which incurred for the purpose of loss minimization. With these, an interest at 18% per annum was also claimed by the insured, with effect from 6th December, 1992, that is four months after the occurrence of the flood or the inundation. All these claims didn’t go well with the National Insurance Company and therefore an appeal was filed by the insurance company in the National Commission.

The National Commission rejected all the contentions urged by the National insurance company and through an impugned judgment an order was issued and the insured was awarded an amount of Rs. 21,05,803.89 with interest at 9% per annum from 11th May, 1995 that is three months after the addendum issued by Seascan Services (WB) Pvt. Ltd. (the second surveyor). An appeal was then made in the Supreme Court.

Issues of the Case

Judgment

According to the facts of the case, the Supreme Court held that on the date of the incident, the goods of the respondent were already insured. On the very next day, a claim was lodged by the company with the national insurance company. In reply to this, the national insurance first appointed a surveyor to assess the loss suffered by the respondent who submitted a report on the same after more than a year. After this, without giving proper reasons, the national insurance appointed a second surveyor which further took one year to submit its report along with the addendum. So, an addendum and a report was submitted, after again a year of time. In simple words, the national insurance, itself took more than two years in surveying or causing a survey of the loss or damage suffered by the insured. This entire delay in their investigation is surely attributable to National Insurance and cannot prejudice the claim of the respondent, more particularly when the respondent had already lodged a claim well within the time specified.

The Supreme Court of India, while resolving the issue of the case, held that, when a dispute is related to a consumer, it becomes necessary for the courts to consider a pragmatic view of the rights of the consumer principally, since it is the consumer who is placed at a disadvantage vis-à-vis the supplier of services or goods. The main agenda behind formulating the Consumer Protection Act, 1996, was to overcome this disadvantage and therefore, this legislation was enacted by the parliament. The provision of limitation in the mentioned Act cannot be strictly construed to disadvantage a consumer in a case where a supplier of goods or services itself is instrumental in causing a delay in the settlement of the consumer claim.

The Supreme Court further held that a right decision was taken by the national commission in rejecting the contention of the National Insurance, in the discussed case, and therefore the appeal was dismissed by the Supreme Court.

Comment

Share