Supreme Court Judgments 2022

by: Adv. Kishan Dutt Kalaskar 2022-11-02 17:33:56

by: Adv. Kishan Dutt Kalaskar 2022-11-02 17:33:56

by: Admin 2022-06-15 18:50:14

by: Admin 2022-06-15 17:09:55

by: Admin 2022-04-28 20:02:29

by: Admin 2022-04-28 19:00:07

by: Admin 2022-04-28 14:03:30

Supreme Court Judgments 2022

Mohan Breweries & Distilleries V/s Commercial Tax officer, Madras

Kavita Kanwar Vs. Mrs Pamela Mehta & Ors

Parminder Kaur V/s State of Punjab

Central Bank of India V/s M/S Maruti Acetylene Co. Ltd.

Goan Real Estate and Construction Ltd. And Anr. V/s Union of India

Raj Kumar V/s Ajay Kumar

Dr. M. Kocher V/s Ispita Seal

Smt. Seema Kumar V/s Ashwin Kumar

Leo Francis Xaviour V/s The Principal, Karunya Institute

Nazir Mohamed V/s J. Kamala and Ors.

Addissery Raghavan V/s Cheruvalath Krishnadasan

Himalaya House Co. Ltd. Bombay V/s Chief Controlling Revenue

K. Sivaram V/s P. Satishkmar

Basir Ahmed Sisodia V/s The Income Tax Officer

Manish V/s Nidhi Kakkar

Surendra Kumar Bhilawe V/s The New India Assurance Company

D. Velusamy V/s D. Patchaimmal

Life Insurance Corporation of India V/s Mukesh Poonamchand Shah

Neelam Gupta Vs Mahipal Sharan Gupta

Sou. Sandhya Manoj Wankhade V/s Manoj Bhimrao Wankhade

G. Raj Mallaih and Anr. V/s State of Andhra Pradesh

Zee Entertainment Enterprise Ltd. V/s Suresh Production

Chief Administrator of Huda &Anr. v/s Shakuntala Devi

Ambalal Sarabhai Enterprise v/s Ks Infraspace LLP

National Legal Service Authority v/s Union of India and Others

Roxann Sharma V/s Arun Sharma

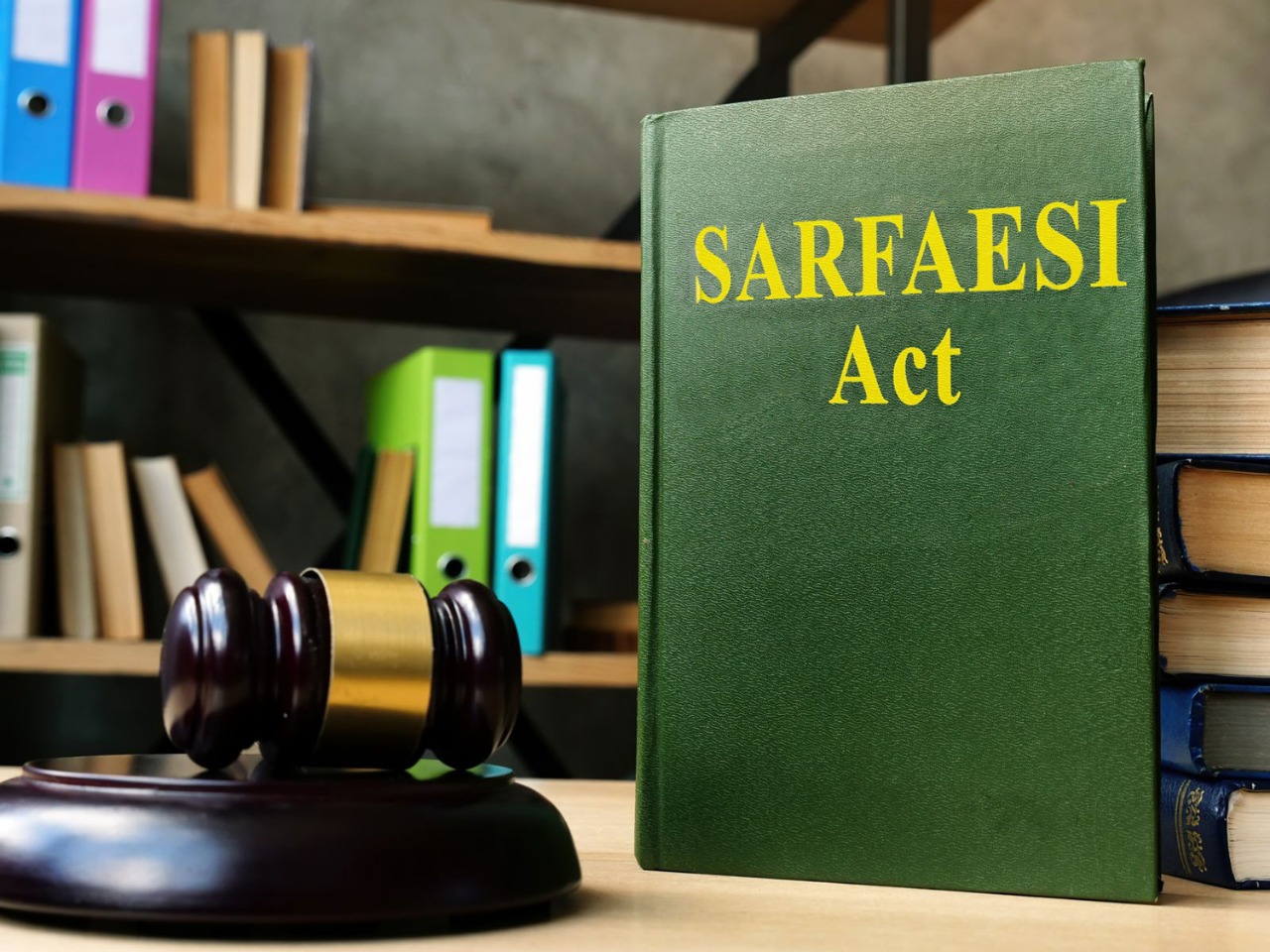

Ganesh Santa Ram Sirur V/s State Bank of India &Anr.

M/s M.M.T.C Ltd. & Anr v/s M/s Medchl Chemical & Pharma P

Shailendra Swarup V/s Enforcement Directorate, The Deputy

SunitaTokas v/s New India Insurance Ltd.

Triloki Nath Singh V/s Anirudh Singh

Milmet Oftho & Ors. V/s Allergan Inc.

Director of Income Tax II (International Taxation) V/s M/s Samsung Heavy Industries Co. Ltd.

M/s ExL Careers V/s Frankfinn Aviation Services Pvt. Ltd.

The Maharashtra State Cooperative Bank Ltd V/s Babulal Lade & Ors.

State of Himachal Pradesh V/s A parent of a student of a Medical College & Ors.

Rathnamma & Ors. V/s Sujathamma & Ors.

Ravinder Kaur Grewal V/s Manjit Kaur

Ficus Pax Pvt. Ltd. V/s Union of Indian & Ors.

Commissioner of Income Tax V/s Chandra Sekhar

Judgment: Indian Bank V/s Abs Marine Product Pvt. Ltd.

Kailas & Ors. V/s State of Maharashtra

Sukhedu Das Vs Rita Mukherjee

National Insurance Co. Ltd V/s Hindustan Safety Glass Works

Mahalakshmi V/s Bala Venkatram (d) through LR & Anr.

Kajal V/s Jagdish Chand

Shyamal Kumar V/s Sushil Kumar Agarwal

Megha Khandelwal V/s Rajat Khandelwal and Ors.

Md. Eqbal & Anrs. V/s State of Jharkhand

A. Jayachandra V/s Aneelkaur

Union of India V/s N. K. Shrivasta

Satvinder Singh V/s State of Bihar

Shreya Singhal V/s Union of India

Shaleen Kabra V/s Shiwani Kabra

Vasant Kumar V/s Vijaykumari

United Commercial Bank & Anr. V/s Deepak Debbarma & others

Vinay Kumar Mittal & Others V/s Deewan Housing Financial Corporation Limited

Mohammed Siddique Vs National Insurance Company Ltd

Top 2019 judgements by Supreme Court

Comment

Share