Intellectual Property: Registration and Effects

by: Adv. Kishan Dutt Kalaskar 2023-03-30 16:34:46

by: Adv. Kishan Dutt Kalaskar 2023-03-30 16:34:46

by: Adv. Kishan Dutt Kalaskar 2023-03-30 16:20:33

by: Adv. Kishan Dutt Kalaskar 2023-02-28 18:47:16

by: Adv. Kishan Dutt Kalaskar 2023-02-28 18:10:41

by: Adv. Kishan Dutt Kalaskar 2023-02-03 22:32:13

by: Admin 2023-02-01 16:45:35

Intellectual Property: Registration and Effects

Clearance to get a Passport and Visa during the pendency of Criminal Cases

Summary of the Payment and Settlement System Act, 2007

Procedure to track court cases online

Key Features of Union Budget 2023

Top 10 reasons to hire a Civil Lawyer

5 Benefits Of Hiring A Business Lawyer When Starting Your Company

Top 5 Reasons Why You Should Consult A Banking Lawyer

10 Things to Consider Before Hiring an Accident Lawyer

Payment Recovery Process

Analyzing legal and security issues in cyber contracts (E - contracts)

Discharging and Quashing in Criminal Cases

Legal compliances for online shopping sites in India

How to select a Lawyer

Supreme Court Judgments 2022

Maternity Benefit Act 1961, at a Glance

Modes of Recording Accepted by Court

Essential elements of a sale under the Transfer of Property Act

Compensation in Motor Vehicle Accident Cases

Is it important to respond to a summon?

Analysis of Section 18 of Limitation Act, 1963

Fresh period of Limitation

The breakdown of the doctrine of Res-Judicat

Impact Of Supreme Court Ruling

Analysis of Employees Provident Fund and Miscellaneous Provisions Act

How is 'BLACK MAGIC' governed in India

Different Identities of an NDA

Breaking down the requirements of becoming a Public Prosecutor in India.

Mohan Breweries & Distilleries V/s Commercial Tax officer, Madras

Kavita Kanwar Vs. Mrs Pamela Mehta & Ors

Entry into Judiciary: Minimum required Qualifications

Law of Retrenchment

Grounds for refusal of a Trademark Application

Early disposal of pending cases by the High Court

Parminder Kaur V/s State of Punjab

Central Bank of India V/s M/S Maruti Acetylene Co. Ltd.

Goan Real Estate and Construction Ltd. And Anr. V/s Union of India

Raj Kumar V/s Ajay Kumar

Synopsis of the Special Marriage Act in India

Lok Adalat has no jurisdiction to decide a matter on Merits

Significance of a Police Clearance Certificate in a pending Accident Case

Understanding the Digital Rupee

Eligibility of Teachers for Gratuity under the Payment of Gratuity Act, 1972

Dr. M. Kocher V/s Ispita Seal

Smt. Seema Kumar V/s Ashwin Kumar

Leo Francis Xaviour V/s The Principal, Karunya Institute

Nazir Mohamed V/s J. Kamala and Ors.

Addissery Raghavan V/s Cheruvalath Krishnadasan

Himalaya House Co. Ltd. Bombay V/s Chief Controlling Revenue

K. Sivaram V/s P. Satishkmar

Basir Ahmed Sisodia V/s The Income Tax Officer

Burden of Proof

Interest for delayed Payment under Payment of Gratuity Act, 1972 - Need for Change?

How to file a complaint in regards to violation of Cyber Laws

Delayed Justice from Consumer Courts

Can a registered Will be challenged in the Indian Court?

Trademark Infringement - Triple identity test in Trademark

Blockchain Technology in India – II

Manish V/s Nidhi Kakkar

Withdrawal of Mutual Divorce Proceedings

Blockchain Technology in India - I

Unnatural Offences

Surendra Kumar Bhilawe V/s The New India Assurance Company

Seat Vs Venue of Arbitration

D. Velusamy V/s D. Patchaimmal

Standard from of Contract - Legal or Illegal?

Life Insurance Corporation of India V/s Mukesh Poonamchand Shah

MSME Debt Recovery Provisions

Neelam Gupta Vs Mahipal Sharan Gupta

Analysis of Section 11A of Industrial Dispute Act, 1947.

Time Limits & Procedure to approach HC in Civil Cases

The necessity of Gender-Neutral laws in India

Sou. Sandhya Manoj Wankhade V/s Manoj Bhimrao Wankhade

Plea of Adjustment

Filing of Complaints against biased Judges

G. Raj Mallaih and Anr. V/s State of Andhra Pradesh

Zee Entertainment Enterprise Ltd. V/s Suresh Production

Chief Administrator of Huda &Anr. v/s Shakuntala Devi

Permanent Child Custody

Dilution of the statutory protection available to MSMEs

Validity of an Unregistered Sale Agreement

Ambalal Sarabhai Enterprise v/s Ks Infraspace LLP

False and misleading advertisements in India

National Legal Service Authority v/s Union of India and Others

Recovery Procedure in Cheque Bounce Cases

Roxann Sharma V/s Arun Sharma

Ganesh Santa Ram Sirur V/s State Bank of India &Anr.

Recovery Procedure of Consumer Court Cases

Bank Guarantee

M/s M.M.T.C Ltd. & Anr v/s M/s Medchl Chemical & Pharma P

Shailendra Swarup V/s Enforcement Directorate, The Deputy

SunitaTokas v/s New India Insurance Ltd.

Can couples get separated without a divorce?

Scope of Arbitration in India

Appointment of Arbitrators

NRIs right to purchase Property in India

Decriminalization of Dishonour of Cheques: a measure contradictory to its purpose

Paternity leave in India

Regulation of Cryptocurrency in India

How can litigants list their cases online?

Validity of Narco-Analysis in India

Remedies against frivolous cases registered against students by the Police

Procedures involved in a Criminal Trial

Procedured Involved in a Family Court Case

Death Certificate of a missing Person

Accountability of Police

Highlight of important Dishonour of Cheque case laws in 2020

Guidelines to be followed by Registered Medical Practitioners to dispense medicines

Land Mark Judgements on Family Law for the Year 2020

Remedies against harassment by Recovery Agents

Abetment to Suicide

Overview of the Vehicle Scrappage Policy

Rights of husbands in dowry and cruelty-based complaints

Admissibility of E-evidence; Are WhatsApp chats and E-mails admissible in Court?

Triloki Nath Singh V/s Anirudh Singh

Milmet Oftho & Ors. V/s Allergan Inc.

Director of Income Tax II (International Taxation) V/s M/s Samsung Heavy Industries Co. Ltd.

M/s ExL Careers V/s Frankfinn Aviation Services Pvt. Ltd.

The Maharashtra State Cooperative Bank Ltd V/s Babulal Lade & Ors.

Constitutionality of Bandhs

State of Himachal Pradesh V/s A parent of a student of a Medical College & Ors.

Rathnamma & Ors. V/s Sujathamma & Ors.

Ravinder Kaur Grewal V/s Manjit Kaur

Ficus Pax Pvt. Ltd. V/s Union of Indian & Ors.

Commissioner of Income Tax V/s Chandra Sekhar

Analysis of Section 41-A of CRPC, 1973

Judgment: Indian Bank V/s Abs Marine Product Pvt. Ltd.

Kailas & Ors. V/s State of Maharashtra

Sukhedu Das Vs Rita Mukherjee

Witness to a Will

National Insurance Co. Ltd V/s Hindustan Safety Glass Works

Mahalakshmi V/s Bala Venkatram (d) through LR & Anr.

Kajal V/s Jagdish Chand

Shyamal Kumar V/s Sushil Kumar Agarwal

NRI's Power of Attorney

Megha Khandelwal V/s Rajat Khandelwal and Ors.

Is Registration Compulsory under Trademark and Copyright?

Md. Eqbal & Anrs. V/s State of Jharkhand

Types of Will

Employment Contract

Police Clearance Certificate

Validity of Crypto-Currency in India

A. Jayachandra V/s Aneelkaur

Points to be considered before filing an Income Tax Return

Union of India V/s N. K. Shrivasta

Startup under the Government Programme

The procedure for filing a complaint against a Lawyer

Types of Stamp Paper

Satvinder Singh V/s State of Bihar

Sexual Violence laws under the Indian Penal Code

Shreya Singhal V/s Union of India

Division of Assets

Shaleen Kabra V/s Shiwani Kabra

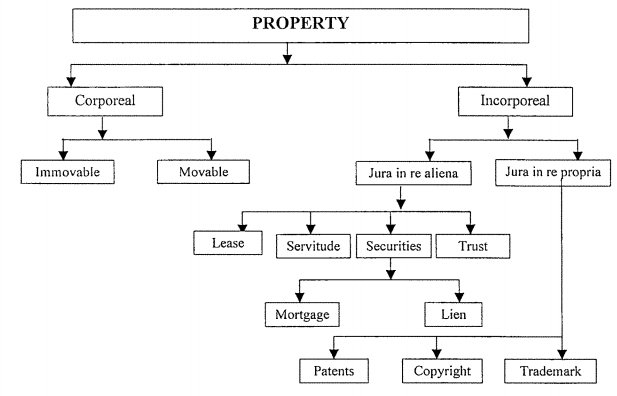

Types of Property

Vasant Kumar V/s Vijaykumari

Personal Injury - Damages

Adultery under the Indian Law

United Commercial Bank & Anr. V/s Deepak Debbarma & others

Intentional Wrongs

Vinay Kumar Mittal & Others V/s Deewan Housing Financial Corporation Limited

How to get a Marriage Certificate?

Mohammed Siddique Vs National Insurance Company Ltd

Pagdi System

The Bonus Act

Frivolous Complaints under the Sexual Harassment Act

Important Income Tax Return Forms and its Due Dates

Garden Leave

How can a Private Complaint be filed?

Key changes to Indian Tax Regulations

Employees Provident Fund

Status of Triple Talaq

Contract Farming & the new ordinances that affect the Farmers

Documents required for filing a Divorce

Section 138, 141 and 142 of the Negotiable Instrument Act 1881

Validity and Enforceability of Click-wrap Agreements

Child Custody under Christian and Parsi Law

Hindu Succession Act

Oppression and Mismanagement

Fraudulent and Invalid Contracts

Developments in Reserve Bank of India

Loan Frauds in India

Penalties associated with Driving

Laws governing a Knife

Medical Negligence and its Compensation

Interim Maintenance under the Domestic Violence Act

Shortcomings of the Consumer Protection Act, 2019

Tougher rules for the E-Commerce Industry

Difficulties faced by men in Family Courts

The consumer is the King in 2020

Illegal Termination of an Employee during Covid-19.

Child Labour Laws in times of Covid-19

Real Estate scenario Post Covid-19

Post Covid-19 Digital Shift of Legal practise

Mutual Consent Divorce through Video Conferencing

59 Chinese Apps banned in India

Litigants and the Lockdown - A Court Perspective

Anticipatory Bail for cases under section 498A of IPC

Brand Protection in times of Covid-19

Title Verification of Immovable Property

The Judiciary during the Pandemic

Termination of an Employee during Covid-19

Drafting of a Will

Criminal Medical Negligence in times of Covid-19

How does Covid-19 affect employers and employees?

Rent deference during the Pandemic

Post Covid-19 digital shift of legal practise

Police Interrogation

Prenuptial Agreements

Void and Voidable Contracts

The Negotiable Instrument Act 1881

Cheque Bounce Notice

Types of Dishonour of Cheques

Intestate Succession

The Stand of Essential Commodities

Trademark Cease and Desist Notice

IT Department Notice

Eviction of a Tenant

Consumer Complaint Legal Notice

Medical Adherence to Environmental Laws

Basic Elements of Transfer of Property Act, 1882

Debt Recovery Notice

Cheque Bounce Notice

Hygiene maintenance in Hospitals and Clinics

Consequences of using a Fake Degree/Certificate

Healthcare Security

Rights of Doctors with respect to Medical Negligence

Importance of Consent

Faulty Machine Aids Medical Negligence

The Special Marriage Act, 1954

Top 2019 judgements by Supreme Court

National Medical Commission Act 2019

Money Laundering

Hindu Undivided Family (HUF)

Child Labour

Endorsement under Negotiable Instrument Act

Quashing of an FIR

Annulment of Marriage

Probate

FAQ's on Trademark

EMI - Equated Monthly Installments

Legal mistakes made by the Start-Up

What is a Stamp Paper?

Sexual Abuse in Shelter Homes

Debt Recovery provisions under the SARFAESI Act

Effective ways to stop Ragging

Transfer of Property Act

Personal Injury Lawyers

Marriage Registration under the Special Marriage Act

Rights of Tenant

Classification of various Collar Jobs

Documents to be submitted for ITR Filing

Illegal Immigrants

Role of lawyers in Corporate Finance

Intestate Succession

Employment of White Collar Employment of White Collar

Domestic Violence

Power of Attorney

Dissolution of Marriage - Christian

Noting And Protest

Hostile Witness

Unfair Trade Practice

All you need to know: Drafting a Legal Notice

Fraudulent and unauthorized transactions at ATM

Is legal documentation important in medical practice?

Why do doctors need to be updated with medical negligence laws?

Personal Data Protection Bill, 2019

Jurisdiction of Consumer Redressal Forums

Does telephonic consultations amount to culpable negligence?

Consumer dispute Redressal Forum in dealing with Medical Negligence

Validity of Notices.

Response to a Legal Notice

Promotion of Medical Products.

Doctors' Bill: Prohibition of Violence & Damage to Property Bill, 2019.

Why less Indemnity cover is risky for Doctors?

Procedure for filing a Notice in India

Format of Legal Notices in India

Citizenship Amendment Act, 2019

Demerger

Legal framework for the Elimination of violence against Women in India

International Day for the Elimination of violence against Women

Family Courts in India

Inheritance Law in India

Rights of Children in India

Virtual Clinic

New Medical Technologies in India

Land Records & Titles

Regulations for firecrackers during Diwali

Legal and Regulatory Regime: Medical Technology

Intellectual Property in Medicine

Consumer Protection Bill, 2019

Artificial Intelligence in healthcare

The Real Estate (Regulation & Development) Act

Warrant and its Types

Joint Custody of Child in India

Limited Liability Partnership (LLP)

Penal Provision on Rash and Negligent Driving

National Company Law Tribunal

Rules to be followed by the Ganpati Mandals

Need to amend CrPC and IPC to increase the conviction rate.

Motor Vehicle Amendment Act, 2019

The Growth of technology Patents in India

Citizenship under the Indian Constitution

Basic Structure of the Indian Constitution

A comparative study of the Indian, UK and the US Constitution

Can the Indian Constitution be Amended?

Overview of the Indian Constitution

All you need to know: Drafting a Legal Notice

Surrogacy (Regulation) Bill, 2019

Overview of The Indian Penal Code

Offences and Prosecution under the Income Tax Act, 1961

The abolishment of Article 370 of the Constitution: One Nation One Flag

Intervention of SC in the Unnao Rape Case

Case of abandoned NRI brides, Supreme Court issues notice to the State

Financial Risk Management

Know more about Equal Remuneration Act, 1976

Procedure to File Complain against Domestic Violence

The IndiGo Promotors Feud

Rajya Sabha passes the Triple Talaq Bill

Gift Deed

More about Contested Divorce

Things to be kept in mind - Dishonor of Cheque

Prison Reforms in India

Consumer Protection ACT, 1986

More about Joint Venture

Delay of Condonation

Points to be Noted for Child Custody to Father

Basic information of Companies

Plastic Money and their Advantage & Disadvantages

Motor Accident Claim Tribunal

Guidelines to protect doctors from frivolous and unjust prosecution

Unjust Compensation - A Doctors Perspective

Misdiagnosis: A Medical Negligence?

Exemption of doctors operating in Emergency Rooms

General Types of Medico-Legal Cases (MLC)

Duty of patient to avoid aiding Medical Negligence

Rights of the Patient

Steps to be taken to avoid Medical Negligence

Liability of Medical Negligence under Consumer Protection Act

Laws that affect Medical Professionals in India

Defense against Medical Negligence Cases

Duties of Doctors

Common types of Medical Negligence

Medical Consent for treatment in India

Regulation for E - Pharmacy in India

Types of Consent for Medical Treatment

Guidelines for Autopsy/ Postmortem in India

Guidelines for the prescription of medicines

Procedure to start a Pharmacy Store in India

India Vs Pakistan: Kulbhushan Jadhav's Case

Contempt of Court

Juvenile Justice Act, 2000

Bankruptcy & Insolvency in India

The Maternity Benefit Act, 1961

Guardian and Ward Act In India

Medical Negligence in India

Procedure to be followed in Civil Recovery Proceedings

Rights of Consumers

Mandatory Registration of Documents and procedure

Rafale Deal And All About The Controversy

Facts

This appeal has been filed before the Supreme Court pursuing the order of dismissal passed by the Honorable High Court of Andhra Pradesh in matter of filing the Income Tax Return, whereby an appeal has been made to set aside the order of the High Court. The respondent herein is also an assesse and a partner in the M/S Manik Rao and Brothers. As per the compliance of the provision of the tax laws he filed the income tax returns for the assessment year 1959 to 1960, 1960 to 1961, 1961 to 1962 and 1962 to 1963 he filed all these returns on the date 2nd of August, 1963 but at the same time he did not filed the return for the assessment year 1963 to 1964, whereas such return was filed by the partner/ respondent on the date 2nd August, 1964. The Income Tax department filed a charge against the assesse believing that such filing of the return is at the fault of the assesse, the official imposed penalty under the income tax act for delayed filing of the return, the penalty imposed was under section 271 sub-sections 1 under clause 2. The appellant filed the submissions in Appellate Assistant Commissioner of Income Tax contending that the return furnished by the appellant were for four years before the assessment year under section 139(4) of the Income Tax Act, 1961 and thus the appellant is not liable for any penalty. The assesse made the submission that the interest has been levied under the provision of the Income Tax Act therefore the department is not liable to charge the penalty to the ass esse. As the department has already levied the interest on the assesse up to the date of the return filed so it was presumed that the department has already anticipates and accepted the return under the provision of extension of filing the return with the authority. The appellant made the prayer to the Appellate Tribunal that any person authorized with judicial and quasi-judicial authority such person should act and oblige himself with integrity and according to the provision of law.

Issues

Court Observation

The Supreme Court stating its observation said that if it is clear that there arises a penalty whereby the provision states to penalize the person for any reason he believes that there is a delayed filing with regards to the Income Tax returns. The person will be allowed to take comfort within the reason provided in a time limit for filling such return under section 139(1) of the Income Tax Act. The Court also has the reason to believe that the Act provides the thorough power to the tax officer to provide the extension of the filling period for the tax return filing. The parliament had expressed power and opportunity to provide in the Act by way of proviso or amendment the exact date of filing the return if any by the same proviso it should’ve authorized the officials for deciding over the extension of the same period if the reason specified deems fit. The Court observed that if there’s extension provided by the officer relying upon the proviso provided by the statute made enforceable by the Parliament, it should have understood or it should be understood by nay assesse as the time period for the payment, filing, and for any reason that arises as an obstacle regarding the tax liability should be resolved within the same time. The Court furthers states that the time period provided by the tax officer will have a statutory effect as per the Tax laws provided and he should have statutory authority under such provision. For furnishing the return it constitutes an integral part of the time allowed for furnishing the return. So when the time extended for any purpose by the tax officer then all the time up to that date will be included for any delayed purpose to repair, any additional time excluding the time extended or from due date will be included for a clear interpretation of the provision under section 271 (a). The Court lies a clear understanding that considers the provision under the tax laws and facts to be considered in the above matter there is no pint of law where it attracts a penalty towards the appellant.

Judgment

The Supreme Court further agree in deciding the matter in favour of the appellant, by considering the earlier order by the Honorable High Court, it states the decision by the earlier court satisfy the objective and should be confirmed. The decision of the High Court stands confirmed and a question raised by the learned counsels are dismissed by the High Court which this Court finds a right fit. All the appeals filed before the court stands dismissed.

Case No.: CA of 1299 – 1303 of 1973

Date: 04/12/1984

Comment

Share